Introduction

Millennials (born between 1981 and 1996) are facing a unique set of financial challenges and opportunities. With rising living costs, significant student debt, and the digitalization of industries, financial planning for this generation demands strategies that address their distinctive circumstances. This article will explore the essentials of financial planning for millennials, offering actionable steps, real-world examples, and an updated perspective on how to secure financial independence and build wealth.

The Millennial Financial Landscape

1. Rising Cost of Living and Wage Stagnation

Millennials are burdened by higher housing costs, healthcare, and education compared to previous generations. According to a report by the Federal Reserve, home prices have increased by nearly 50% since 2000, but real wages have only risen by 9%. Consequently, millennials need to develop sophisticated strategies to bridge the gap between living costs and income.

2. Student Loan Debt

Student debt is one of the most significant financial pressures on millennials. The average U.S. student loan borrower from this generation owes about $30,000, according to the Federal Reserve. This substantial burden impacts their ability to invest, buy homes, and save for retirement. In response, financial plans must emphasize managing and reducing debt.

3. Digital and Gig Economy

Millennials are leading participants in the gig economy, with nearly 50% of freelancers under the age of 35. While this provides flexibility, it also means unpredictable income, making financial planning more complex. As the digital economy expands, millennials need to be proactive in building financial security despite irregular earnings.

Key Steps for Financial Planning

1. Setting Financial Goals

Financial planning begins with clear, realistic goals. Millennials should consider both short-term (saving for a down payment, vacation, or emergency fund) and long-term objectives (retirement, investment portfolios, or paying off student loans).

Actionable Steps:

- SMART Goals: Set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, saving $10,000 for an emergency fund within two years.

- Create a Vision Board: Visually represent financial goals to maintain motivation and focus.

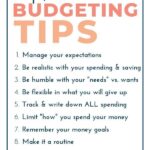

2. Building a Budget

A solid budget is the foundation of financial security. Budgeting helps control spending, manage debt, and ensure savings growth. Popular apps like Mint and YNAB (You Need A Budget) can assist with this, enabling millennials to track and optimize spending.

Actionable Steps:

- 50/30/20 Rule: Allocate 50% of income to needs (rent, utilities), 30% to wants (entertainment, dining), and 20% to savings and debt repayment.

- Use Digital Tools: Automate bill payments and savings contributions to ensure consistency.

- Real-World Example: Sarah, a 28-year-old software developer, reduced her discretionary spending by 15% after reviewing her spending habits with a budgeting app, enabling her to increase her student loan repayments.

3. Tackling Debt Strategically

Student loans, credit card debt, and car loans can slow financial progress. Millennials need to adopt strategies to manage and pay off debt systematically.

Actionable Steps:

- Snowball vs. Avalanche Method: The snowball method pays off the smallest debts first to build momentum, while the avalanche method tackles the highest-interest debt first to reduce overall costs.

- Refinancing Student Loans: Investigate refinancing options to reduce interest rates or extend payment terms for more manageable monthly payments.

Case Study: Jason, a 30-year-old marketing manager, used the avalanche method to pay down his $25,000 in credit card debt. By targeting his high-interest loans first, he saved $5,000 in interest payments over five years.

4. Building an Emergency Fund

Financial security demands that millennials have a buffer against unexpected expenses like medical emergencies or job loss. Most experts recommend saving at least 3-6 months’ worth of living expenses.

Actionable Steps:

- Automate Savings: Set up automatic transfers from checking to savings accounts to ensure consistent growth of the emergency fund.

- High-Interest Savings Accounts: Maximize returns by keeping emergency funds in high-interest savings accounts.

5. Investing for the Future

Millennials have a significant advantage over older generations: time. By starting early, they can leverage compound interest to grow their investments, making it essential to develop an investment strategy that aligns with their financial goals.

Actionable Steps:

- Employer-Sponsored Retirement Plans (401(k)/IRA): Maximize contributions to retirement accounts, especially if employers offer matching contributions.

- Diversify Investments: Invest in a mix of stocks, bonds, and ETFs to balance risk and reward.

- Consider Robo-Advisors: For beginners, robo-advisors like Betterment or Wealthfront provide low-cost, automated investment management tailored to risk tolerance and goals.

Real-World Example: Olivia, a 32-year-old freelance graphic designer, began investing 15% of her income in index funds. After ten years, her portfolio has grown significantly due to compounded returns, placing her well on the path to financial independence.

6. Protecting Income and Assets

Insurance plays a critical role in protecting against financial catastrophe. Millennials, especially those with dependents or significant debt, should prioritize adequate insurance coverage.

Actionable Steps:

- Health and Life Insurance: Ensure adequate health insurance coverage to avoid the financial impact of medical emergencies. Life insurance is essential for those with dependents.

- Disability Insurance: Consider disability insurance, especially for those in the gig economy, to protect income in the event of injury or illness.

Modern Financial Tools for Millennials

1. Fintech Solutions

The fintech revolution has made it easier than ever to manage finances. From budgeting apps to digital investment platforms, millennials have access to tools that simplify financial management.

Popular Tools:

- Acorns: Invest spare change from everyday purchases automatically.

- Mint: Comprehensive budgeting and bill management.

- Wealthfront: A low-cost robo-advisor for hands-off investing.

2. Cryptocurrency and Digital Assets

Millennials are leading the adoption of cryptocurrency. While digital assets like Bitcoin and Ethereum are volatile, they offer high-risk, high-reward opportunities for millennials who can afford to take calculated risks.

Actionable Steps:

- Diversification: Limit exposure to cryptocurrency to a small percentage of the overall portfolio.

- Education: Understand the risks, tax implications, and long-term outlook before investing in digital currencies.

The Role of Financial Education

Financial literacy remains a significant challenge. A survey by the Financial Industry Regulatory Authority (FINRA) revealed that only 24% of millennials demonstrated basic financial literacy. Improved financial education is essential for millennials to make informed decisions.

Actionable Steps:

- Seek Out Resources: Leverage free online courses, podcasts, and books to build financial knowledge. “The Simple Path to Wealth” by JL Collins and “I Will Teach You to Be Rich” by Ramit Sethi are highly recommended.

- Consult a Financial Advisor: For personalized advice, especially for complex situations like taxes or investments, consider consulting a certified financial planner.

Frequently Asked Questions

Conclusion: Achieving Financial Independence

Financial planning for millennials is not without its challenges, but by setting clear goals, managing debt effectively, and investing early, financial independence is attainable. The combination of accessible digital tools and long-term planning strategies provides millennials with a unique opportunity to overcome the economic hurdles of their generation.

Key Takeaways:

- Set SMART Financial Goals: Prioritize both short-term and long-term objectives.

- Automate Finances: Automating savings and investments can streamline financial management and build consistency.

- Leverage Time: Starting early with investments, even with small amounts, takes advantage of compound interest.

- Stay Informed: Ongoing financial education is key to adapting to changing markets and opportunities.

For more detailed steps on how to create a household budget, check out this guide on household budgeting.

Additionally, consider reading this comprehensive article from Investopedia on Millennial Money Management for further insights on effective financial strategies.

By adopting these strategies, millennials can create a solid financial foundation and build a prosperous future in an ever-evolving economic landscape.

1 thought on “Financial Planning for Millennials: A Comprehensive Guide”