Financial Foundations: Essential Personal Finance Tips for Newbies

Keywords: personal finance basics, money management tips, financial literacy, budgeting advice

Introduction

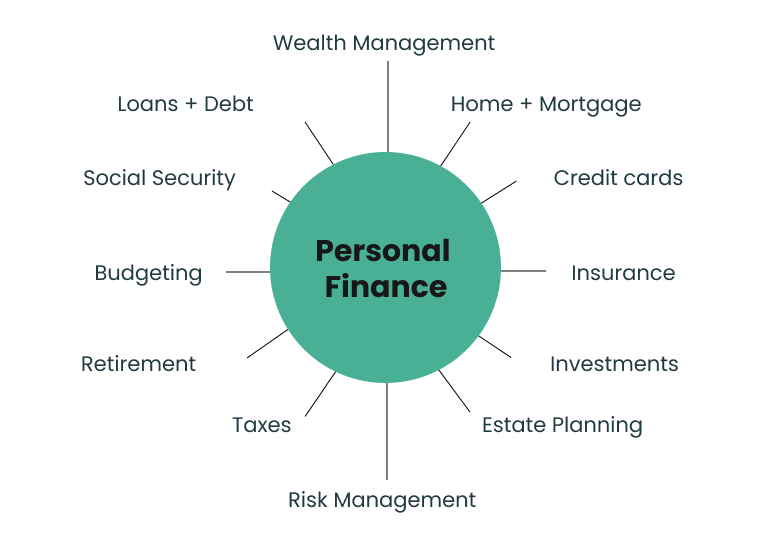

Starting your financial life on solid ground can feel overwhelming—bank accounts, credit scores, student loans, saving, investing—the list seems endless. But you don’t need to be an expert to take control. This guide breaks down personal finance basics into clear, practical steps you can apply right away. You’ll learn essential money management tips, trustworthy budgeting advice, and simple ways to improve your financial literacy so your decisions feel confident and intentional.

By the end of this article you’ll understand how to create a working budget, build an emergency fund, manage debt, begin investing, protect your money, and form habits that keep your finances healthy. Each section includes actionable steps, examples, and quick takeaways so you can move from confused to capable—one smart choice at a time.

Why Financial Literacy Matters

Financial literacy is the foundation of financial freedom. Knowing how money works gives you the power to meet short-term needs, plan for long-term goals, and avoid costly mistakes. Studies show people with higher financial literacy are more likely to save, invest, and have lower debt levels.

For beginners, improving financial literacy translates into better daily choices: picking the right bank account, understanding interest, recognizing predatory loans, and building a budget that actually fits your life. Think of financial literacy as a map—you don’t need to be an expert cartographer, but you do need a reliable map to reach your destination.

Core Personal Finance Basics

1. Know Your Income and Expenses

Start by tracking everything for 30 days. List all income sources (after-tax amounts) and every expense—rent, groceries, subscriptions, coffee runs. Use a simple spreadsheet, an app, or a notebook.

- Income: salary, side gigs, benefits, gifts.

- Fixed expenses: rent/mortgage, insurance, loan payments.

- Variable expenses: food, transport, utilities, entertainment.

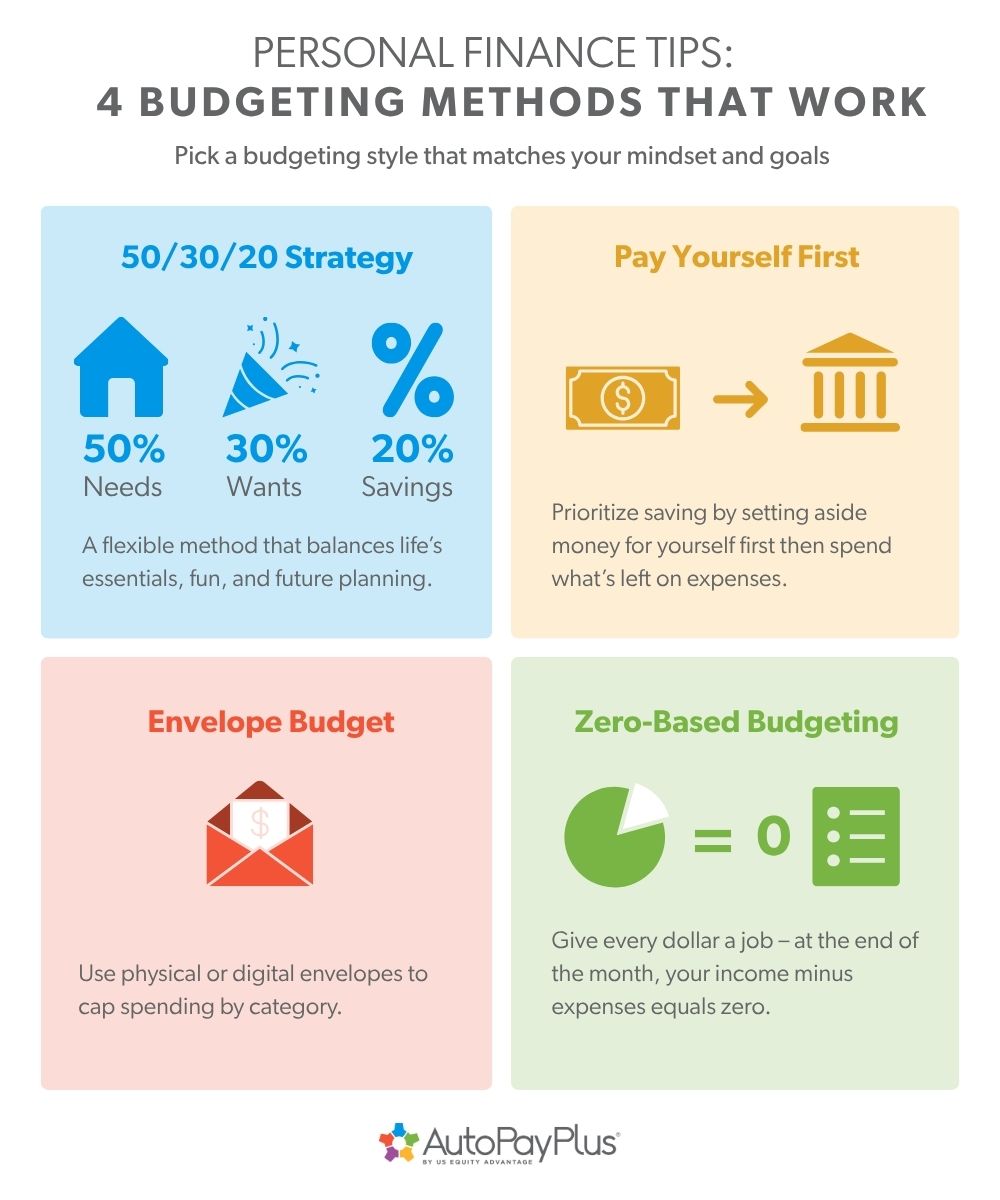

- Zero-based budget: Every dollar is given a job—savings, bills, spending—until your income minus expenses equals zero.

- 50/30/20 rule: Allocate 50% to needs, 30% to wants, and 20% to savings and debt repayment.

- Set a small initial goal: $500–$1,000 to start.

- Automate transfers to a high-yield savings account.

- Use windfalls (tax refunds, bonuses) to accelerate the fund.

- Debt avalanche: Pay highest-interest debt first while making minimum payments on others—saves you the most interest.

- Debt snowball: Pay smallest balances first to build momentum and motivation.

- No monthly maintenance fees

- ATM fee reimbursements (if you travel)

- Competitive APY on savings

- User-friendly mobile app

- Bill payments to avoid late fees

- Recurring transfers into savings and investment accounts

- Debt payments to ensure consistency

- Pay bills on time. Payment history matters most.

- Keep credit utilization under 30% of available credit.

- Don’t open too many new accounts quickly.

- Check your credit report annually for errors (annualcreditreport.com in the U.S.).

- Contribute at least enough to get employer match.

- If possible, increase contributions by 1% each year or with raises.

- Target retirement asset allocation by age or use target-date funds for simplicity.

- Index funds and ETFs that track broad markets (S&P 500, total-market funds)

- Dollar-cost averaging: invest a fixed amount regularly to reduce timing risk

- Keep fees low—expense ratios and trading fees compound over time

- Health insurance

- Auto insurance (if you drive)

- Renters’ or homeowners’ insurance

- Disability insurance for income protection

- Using unique, strong passwords and a password manager

- Enabling two-factor authentication on financial accounts

- Monitoring accounts regularly and setting up text/email alerts

- Being wary of unsolicited calls, phishing emails, and “too good to be true” offers

- Paying only minimum credit card payments—leads to high interest—aim to pay balances in full when possible.

- Neglecting emergency savings—leads to reliance on high-interest debt during emergencies.

- Chasing high returns without understanding risk—stick to diversified, low-cost investments.

- Ignoring retirement until later—time in the market matters more than timing the market.

- Budgeting apps: Mint, YNAB (You Need A Budget), Personal Capital

- Investing platforms: Vanguard, Fidelity, Schwab, robo-advisors like Betterment and Wealthfront

- High-yield savings accounts: online banks tend to offer better APYs

- Credit score monitoring: Credit Karma, Experian, TransUnion services

- Tracks spending for a month and sees she spends $300 on dining out.

- Creates a 50/30/20 budget and shifts $100/month from dining to savings.

- Opens a high-yield savings account and automates $200 monthly to it until she reaches $1,000 emergency fund.

- Enrolls in her employer’s 401(k) and contributes 4% to get the full employer match.

- Uses a debt snowball to pay off a $1,200 credit card balance, then applies that payment to student loans.

- Track all income and expenses for 30 days.

- Create a budget (50/30/20 or zero-based).

- Open a high-yield savings account and save $500–$1,000 as a starter emergency fund.

- Set up autopay for bills and an automatic transfer to savings.

- If you have credit card debt, pick a payoff strategy (avalanche or snowball) and make a plan.

- Sign up for your employer retirement plan and contribute enough to get any match.

- Internal: Link to a “Beginner’s Budget Template” page with anchor text “budget template”

- Internal: Link to a “Retirement Basics” article with anchor text “retirement planning”

- External: Link to authoritative resources such as the Consumer Financial Protection Bureau (https://www.consumerfinance.gov) for budgeting and credit report guidance

- External: Link to IRS pages for tax-advantaged accounts (https://www.irs.gov) when discussing IRAs and retirement accounts

- Hero image: person organizing finances at a desk — alt: “Young person organizing personal finances with laptop and notebook”

- Budgeting table screenshot — alt: “Example monthly budget table showing income and expense categories”

- Emergency fund jar or piggy bank — alt: “Jar labeled emergency fund next to coins”

- “Start small: automate $25/month into savings and build momentum.”

- “Pay yourself first—set up automated transfers to your emergency fund.”

Quick tip: categorize expenses into essentials, non-essentials, and savings/debt payments to see where you can realistically cut back.

2. Build a Practical Budget (Budgeting Advice)

A budget turns goals into a plan. Here are two beginner-friendly approaches:

Choose the method that fits your lifestyle. The most effective budget is the one you stick to.

3. Create an Emergency Fund

An emergency fund protects you from unexpected costs—car repairs, medical bills, or temporary job loss. Aim for 3–6 months of essential expenses if you’re stable, or 6–12 months if your income is irregular.

How to build it:

4. Manage and Reduce Debt

Debt isn’t always bad—mortgages and student loans can be investments in your future—but high-interest debt (credit cards, payday loans) is costly. Prioritize paying it down.

Two proven payoff strategies:

Also consider consolidation or refinancing only if it lowers your interest rate and fees. Avoid extending term lengths that increase total interest unless necessary.

Practical Money Management Tips

1. Use the Right Bank Accounts

Choose a checking account with low or no fees and easy access. Put savings in a high-yield savings account or money market account to earn more interest while keeping funds accessible.

Look for:

2. Automate Where Possible

Automation is the easiest way to pay yourself first and avoid missed payments. Automate:

3. Track Subscriptions and Recurring Charges

Many people lose money to forgotten subscriptions. Review monthly statements to identify and cancel unused services. Consider consolidating streaming services or sharing family plans to save money.

h3>4. Understand Interest and Credit (Credit Scores)

Your credit score impacts your ability to borrow and the rates you’ll pay. Basic actions that protect and improve credit:

Saving and Investing: How to Begin

1. Retirement Accounts

Start saving for retirement early—compounding is powerful. Use employer-sponsored plans (401(k), 403(b)) especially if employer offers matching contributions—this is effectively free money.

If you don’t have access to an employer plan, consider an Individual Retirement Account (IRA) or Roth IRA depending on your income and tax situation.

General guidance:

2. Basic Investing Principles

For most beginners, low-cost, diversified investments are the best start. Consider:

Example: Investing $200 monthly into a broad market index fund with a 7% annual return grows substantially over decades due to compounding.

3. Emergency vs. Investing Balance

Keep the emergency fund fully funded before making significant investment moves. Once you have 3–6 months of living expenses, prioritize retirement account contributions and tax-advantaged options.

Protecting Your Financial Health

1. Insurance Basics

Insurance prevents financial catastrophe. Fundamental coverages include:

Shop around periodically to ensure competitive rates and appropriate coverage limits.

2. Fraud Prevention and Safe Practices

Protect your identity and accounts by:

Behavioral Money Tips: Building Good Habits

1. Make Small, Sustainable Changes

Big changes are hard to maintain. Instead of cutting out all dining out, reduce frequency by one meal a week and channel savings to your emergency fund.

2. Use Accountability and Visual Progress

Share goals with a trusted friend or use apps that visualize progress toward savings or debt targets. Seeing momentum helps maintain motivation.

3. Educate Yourself Continuously

Financial literacy is ongoing. Read books, follow reputable blogs, and consider short courses. Aim to learn a new concept each month—compounding knowledge mirrors compounding money.

Common Beginner Mistakes and How to Avoid Them

Tools and Resources (Financial Literacy)

Useful tools for beginners:

Recommended beginner reads: “The Simple Path to Wealth” by JL Collins, “I Will Teach You to Be Rich” by Ramit Sethi, and “Your Money or Your Life” by Vicki Robin and Joe Dominguez.

Real-World Example: Sarah’s First Year of Financial Foundations

Sarah graduates college and lands a job with a $45,000 salary. She follows these steps:

One year later, Sarah has a $3,000 emergency fund, a paid-off credit card, and 6% of her salary in retirement—small consistent steps that created momentum.

Action Plan: First 90 Days

Begin with a simple 90-day plan to build momentum:

Frequently Asked Questions (FAQ)

How much should I save each month?

Aim for at least 20% of your after-tax income toward savings and debt repayment combined. If that’s not possible, start with a smaller automated amount and increase it each time your income rises or expenses decrease.

Should I pay off debt or invest first?

Build a small emergency fund ($500–$1,000) first. Then, prioritize high-interest debt (credit cards). For lower-interest, long-term debt (federal student loans), balance paying down debt with contributing to retirement—especially to capture employer matches.

What’s the best budgeting method?

There’s no one-size-fits-all. The 50/30/20 rule works for many beginners because it’s simple. Zero-based budgets offer more control. Choose a method you can follow consistently.

Internal and External Linking Suggestions

For readers and SEO, consider these link placements:

Image Recommendations and Alt Text

Schema Markup Recommendation

Use Article schema with these properties: headline, description, author, datePublished, image, publisher. Include FAQ schema for the FAQ section to improve chances of appearing in rich results.

Social Sharing Optimization

Create shareable excerpts and images for social platforms. Suggested tweetable lines:

Conclusion

Mastering personal finance basics doesn’t require magic—just a few consistent habits and the right knowledge. Track your money, create a realistic budget, build an emergency fund, manage debt sensibly, and start saving for retirement as soon as you can. Small, repeatable actions compound into big results over time.

Start your 90-day action plan today: track, budget, automate, and protect. Your future self will thank you.

Author Note

Written for beginners who want clear, practical steps to build a strong financial foundation. For further reading, explore the recommended books and tools above, and consider subscribing to a finance newsletter to keep learning.