Boost Immunity with Nutrition and Exercise: Daily Healthy Habits & Lifestyle Strategies

Daily Healthy Habits to Boost Immunity with Nutrition and Exercise | Immunity-Boosting Foods & Daily Exercise Routine Daily Healthy Habits to Boost Immunity with Nutrition and ExerciseShort summary: Practical, science-backed daily habits combining immunity-boosting foods and a consistent daily exercise routine to create a healthy lifestyle that supports long-term wellness. Introduction: Why daily habits matter...

Read more

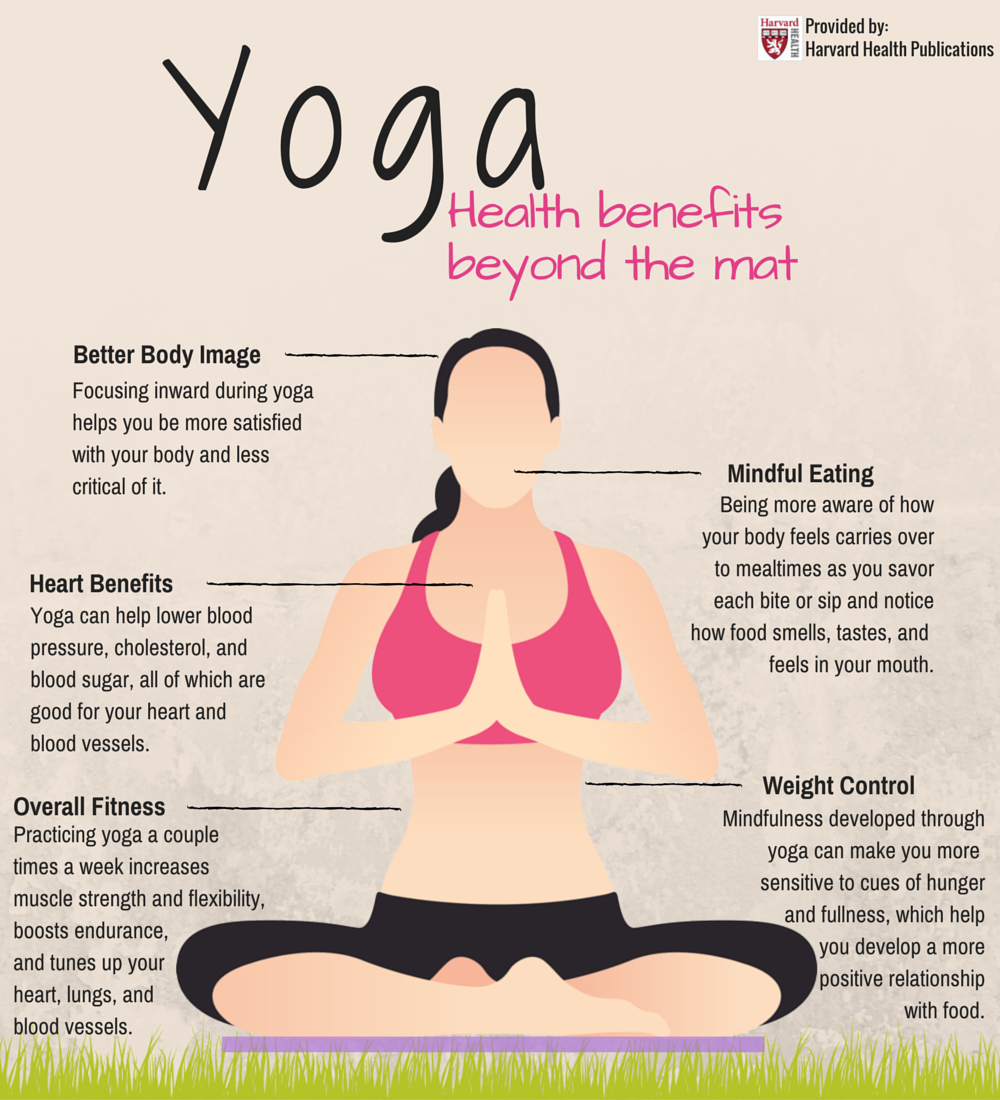

Elevate Body and Mind with Yoga: Unveiling the Benefits for Holistic Wellness

Elevate Body and Mind: Exploring Yoga Benefits for Well-beingElevate Body and Mind: Exploring Yoga Benefits for Well-beingKeywords: yoga benefits, mind-body connection, yoga practice, holistic wellnessIntroduction: A Gentle Invitation to Transform Have you ever noticed how a few deliberate breaths can make a noisy day feel quieter? Yoga invites that same simple recalibration—one that ripples from...

Read more

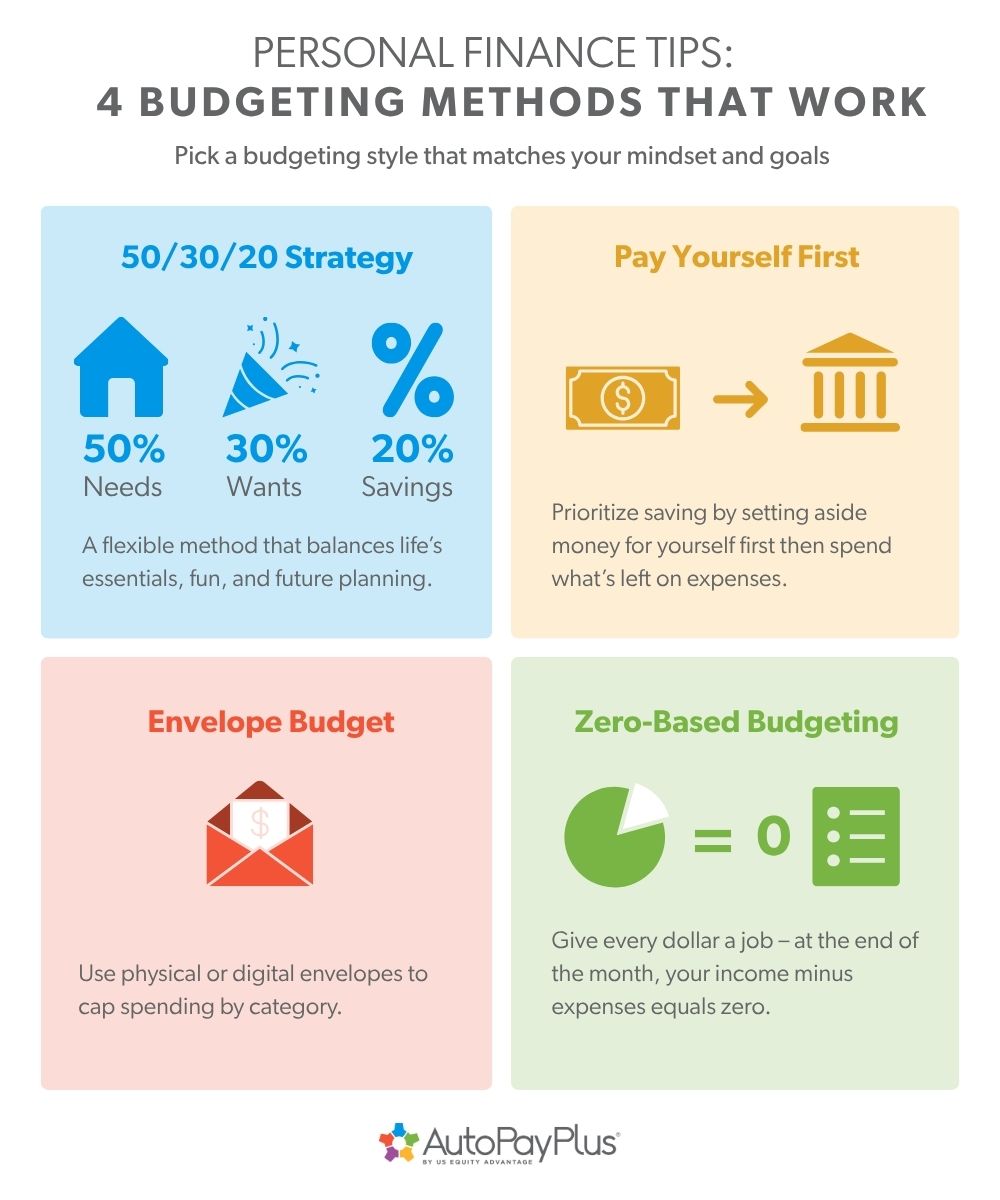

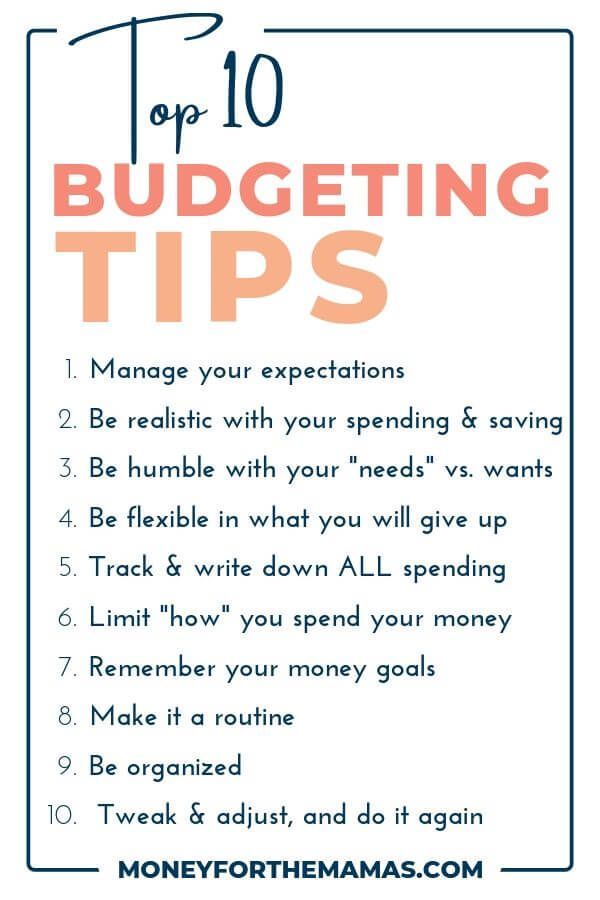

Empowering Budgeting Tips for Low-Income Earners: Money-Saving Strategies and Frugal Living Solutions

Thriving on a Budget: Practical Budgeting Tips & Money-Saving Strategies for Low-Income Earners Thriving on a Budget: Practical Budgeting Tips & Money-Saving Strategies for Low-Income Earners Keywords: budgeting tips, saving money, low salary strategies, frugal living Introduction Living on a low salary doesn’t mean you can’t build financial stability, reach goals, or enjoy life. With...

Read more

Boost Your Immunity: Daily Habits for a Healthy Lifestyle

Daily Healthy Habits to Boost Immunity with Nutrition and ExerciseKeywords: immunity-boosting foods, daily exercise routine, healthy lifestyle, wellness tipsFeeling resilient starts with daily choices. This article gives you a practical, science-backed roadmap to strengthen your immune system with the right nutrition and exercise habits. You'll get actionable wellness tips, sample meal ideas, a realistic daily...

Read more

Easy Home Workout Routine for Beginners: Effective Fitness Exercises without a Gym

Beginner’s Guide to Home Workouts: Easy Exercises for Fitness NewbiesKeywords: home workout routine, beginner exercises, fitness at home, workout plans for beginnersStarting a fitness journey can feel overwhelming, but it doesn’t have to be. This beginner’s guide to home workouts is designed to empower you with simple, effective, and safe routines you can do without...

Read more

Financial Foundations for Beginners: Expert Personal Finance Tips and Budgeting Advice for Newbies

Financial Foundations: Essential Personal Finance Tips for Newbies Financial Foundations: Essential Personal Finance Tips for Newbies Keywords: personal finance basics, money management tips, financial literacy, budgeting advice Introduction Starting your financial life on solid ground can feel overwhelming—bank accounts, credit scores, student loans, saving, investing—the list seems endless. But you don’t need to be an...

Read more

Best Budgeting Tips for Managing Monthly Expenses: Master Your Finances and Achieve Financial Stability

Master Your Finances: Best Budgeting Tips for Managing Monthly ExpensesStruggling to make your paycheck last the month? You’re not alone. Nearly half of adults report living paycheck to paycheck, and unexpected expenses can derail even the best intentions. The good news: effective budgeting techniques and smart monthly expenses management can give you control, reduce stress,...

Read more

Work-Life Balance Tips for Busy Professionals: Boost Productivity and Well-being

Healthy Habits for Busy Professionals: Simple Tips for Work-Life BalanceHealthy Habits for Busy Professionals: Simple Tips for Work-Life BalanceKeywords: work-life balance, health tips for professionals, stress management, productivity hacksIntroduction: Why Work-Life Balance Matters for Busy ProfessionalsDo you constantly feel pulled in a dozen directions—email, meetings, family, deadlines—while your health quietly slips down the list? You're...

Read more

Revitalize Your Day: Morning Routine for a Healthier You – Energizing Habits & Wellness Tips

Revitalize Your Day: Morning Routine for a Healthier You — Morning Habits & Energy-Boosting Practices Revitalize Your Day: Morning Routine for a Healthier You Start your morning with intention and energy. Discover practical morning habits and healthy lifestyle tips to create a daily wellness routine that boosts your mood, increases focus, and sustains energy all...

Read more

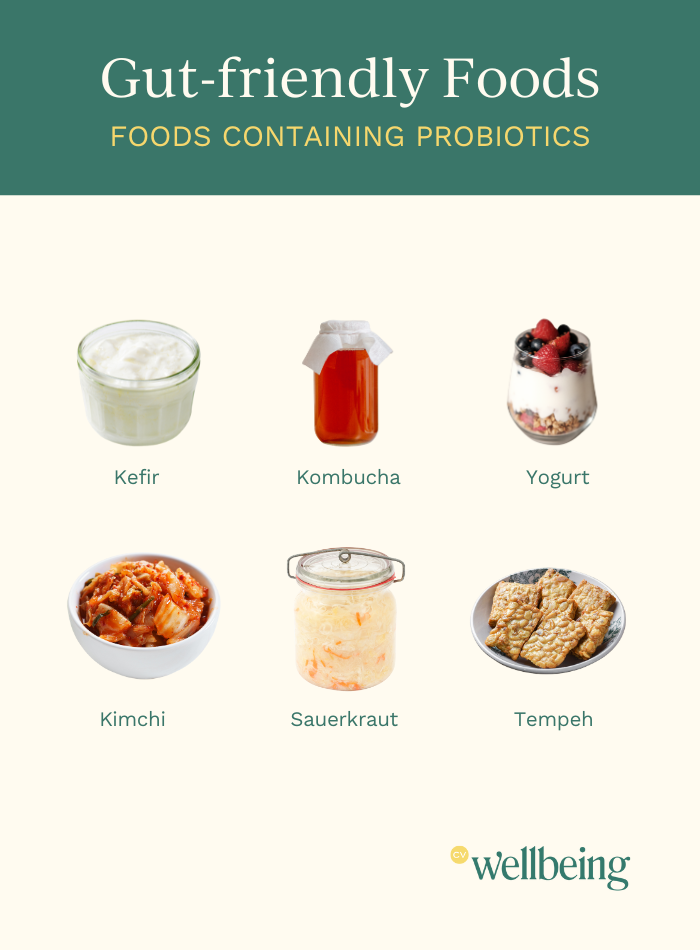

Top 10 Gut-Friendly Foods: Boost Digestion with These Practical Tips

Optimize Digestion with Top 10 Gut-Friendly Foods and Practical TipsStruggling with bloating, irregularity, or sluggish digestion? You're not alone. Small, consistent changes in what you eat and how you live can dramatically improve gut health and ease common digestive complaints. In this comprehensive guide you'll learn the top 10 foods for digestion, evidence-based digestive system...

Read more