Master Your Finances: Best Budgeting Tips for Managing Monthly Expenses

Struggling to make your paycheck last the month? You’re not alone. Nearly half of adults report living paycheck to paycheck, and unexpected expenses can derail even the best intentions. The good news: effective budgeting techniques and smart monthly expenses management can give you control, reduce stress, and accelerate your financial goals. In this practical, insightful guide you’ll find a step-by-step plan, money-saving hacks, and real-world examples to help you build a budget that works for your life—whether you’re a beginner or need to tighten up an existing plan.

What You’ll Learn

- Proven budgeting techniques to track income and expenses with ease

- How to categorize, prioritize, and cut monthly expenses without feeling deprived

- Money-saving hacks to boost savings and reduce recurring costs

- How to build a realistic financial plan and stick to it long term

- Tools, templates, and next steps to implement immediately

- Cover essentials consistently (rent/mortgage, utilities, groceries)

- Avoid late fees, overdrafts, and high-interest debt

- Build emergency savings to protect against shocks

- Allocate funds to priorities like retirement, travel, or debt payoff

- Best for: People who want tight control and accountability

- How to implement: List all income sources, assign amounts to every expense and savings goal, track monthly, adjust as needed

- Example: If you earn $3,500/month, allocate exact dollar amounts to each category—$1,200 rent, $400 groceries, $300 utilities, $500 savings, $200 debt payoff, $300 entertainment, etc.

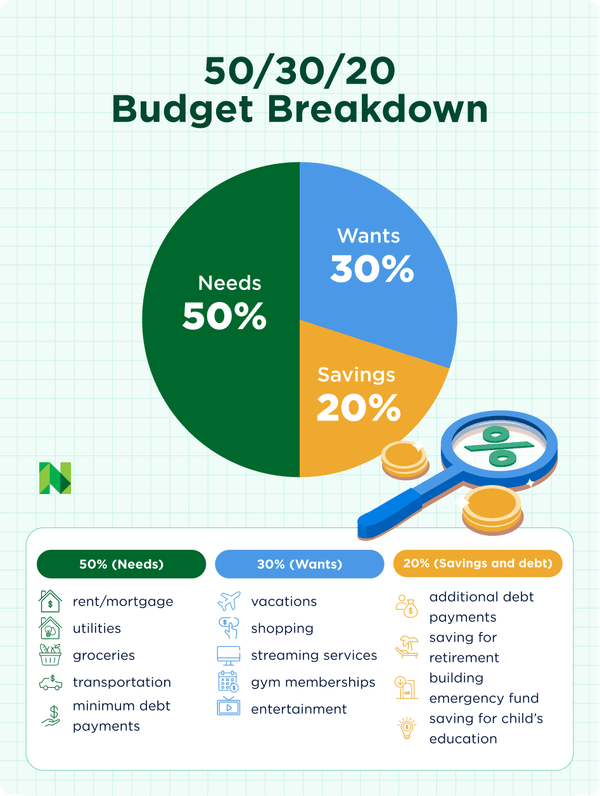

- Best for: Beginners or those who prefer a flexible approach

- How to implement: Calculate your after-tax income, divide accordingly, and refine category definitions

- Example: $4,000 take-home → $2,000 needs, $1,200 wants, $800 savings/debt

- Best for: People who overspend or want disciplined control over discretionary spending

- How to implement: Use cash envelopes or digital wallets/budgeting apps that simulate envelopes

- Best for: Those who struggle to save consistently

- How to implement: Set up automatic transfers to savings, retirement, or investment accounts on payday

- Tip: Categorize as fixed (rent, loan payments) or variable (groceries, gas).

- Audit subscriptions every 3 months. Cancel underused streaming, app, or service subscriptions.

- Negotiate annual billing or combine services to reduce costs.

- Switch to energy-efficient bulbs, seal drafts, and use programmable thermostats.

- Shop electricity and internet plans during contract renewal periods for better deals.

- Shop with a list, buy seasonal produce, and use loyalty programs and coupons.

- Plan meals around sales and reduce food waste by batch-cooking and freezing portions.

- Carpool, use public transit, or bike when possible. Compare gas prices using apps and maintain proper tire pressure to improve fuel efficiency.

- Consider refinancing or selling a second car if it’s underused.

- Target high-interest debt first (avalanche method) or start with small balances for quick wins (snowball method).

- Refinance loans or consolidate credit card debt into a lower-rate personal loan if it reduces interest and fees.

- Buy quality items that last rather than cheap replacements; use price tracking tools and set alerts.

- Wait 24–48 hours before big purchases to avoid impulse buys.

- YNAB (You Need A Budget) — great for zero-based budgeting and envelope-style organization

- Mint — tracks accounts automatically and offers free budgeting features

- EveryDollar — simple zero-based budgeting with an intuitive interface

- Personal Capital — strong for investment and net worth tracking

- Spreadsheet templates — highly customizable and private; use Google Sheets or Excel

- Not accounting for irregular expenses — use sinking funds

- Setting unrealistic goals — start small and increase targets incrementally

- Ignoring behavioral triggers — recognize emotional spending patterns and plan alternatives

- Relying solely on apps without regular reviews — schedule monthly budget check-ins

- Set short-term milestones and celebrate small wins (a modest treat or an experience rather than a purchase)

- Use visual trackers (savings thermometers, progress bars) to see progress

- Pair budgeting with accountability—share goals with a partner or friend

- Automate as many decisions as possible to reduce friction

- Personal Finance Basics — anchor: “personal finance basics”

- Saving Hacks for Families — anchor: “saving hacks”

- Best Budgeting Apps 2026 — anchor: “budgeting apps”

- U.S. Bureau of Labor Statistics — Consumer Expenditure Survey (https://www.bls.gov) — for spending data and trends

- Consumer Financial Protection Bureau — Financial Well-Being resources (https://www.consumerfinance.gov) — for budgeting tools and advice

- Investopedia — articles on debt payoff strategies and budgeting methodologies (https://www.investopedia.com)

- Hero image suggestion: a friendly photo of someone reviewing a budget at a kitchen table with a laptop & coffee — alt text: “Person managing monthly budget at home with laptop and bills”

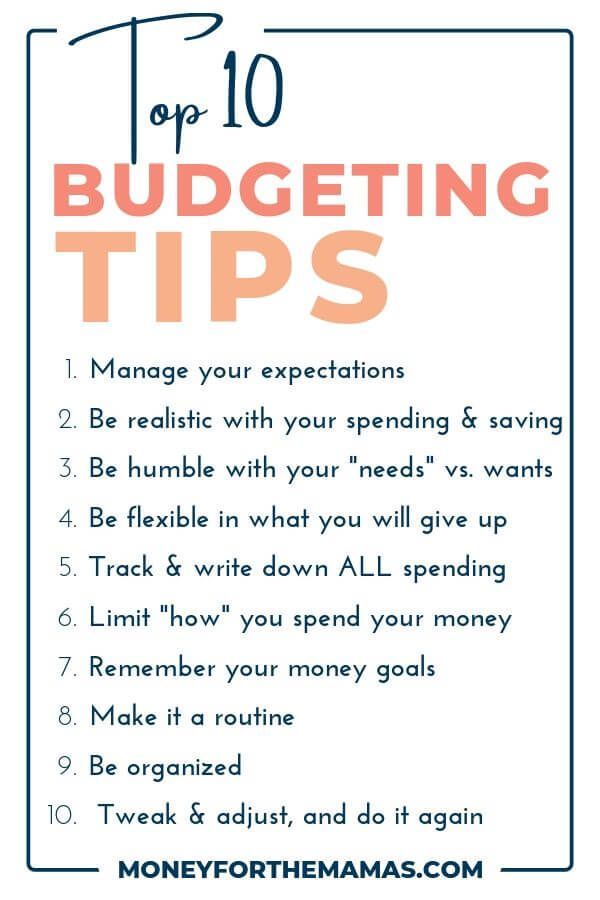

- Infographic: “Monthly Budget Checklist” — alt text: “Checklist infographic for building a monthly budget”

- Table screenshot: 50/30/20 breakdown example — alt text: “Example of 50/30/20 budget allocations”

- @type: “Article”

- Suggested tweet: “Master your finances with practical budgeting techniques and simple money-saving hacks. Start managing monthly expenses better today!”

- Suggested Facebook post: “Struggling to stretch your paycheck? This guide breaks down budgeting techniques, money-saving hacks, and real steps to manage monthly expenses with confidence.”

- Suggested LinkedIn post: “Financial planning starts with a smart budget. Read this practical guide to budgeting techniques and monthly expenses management for professionals.”

Why Budgeting Matters: The Big Picture

Budgeting isn’t just about restrictions—it’s about choices. A clear budget transforms vague financial worries into actionable decisions: what to keep, what to trim, and what to prioritize. Effective monthly expenses management helps you:

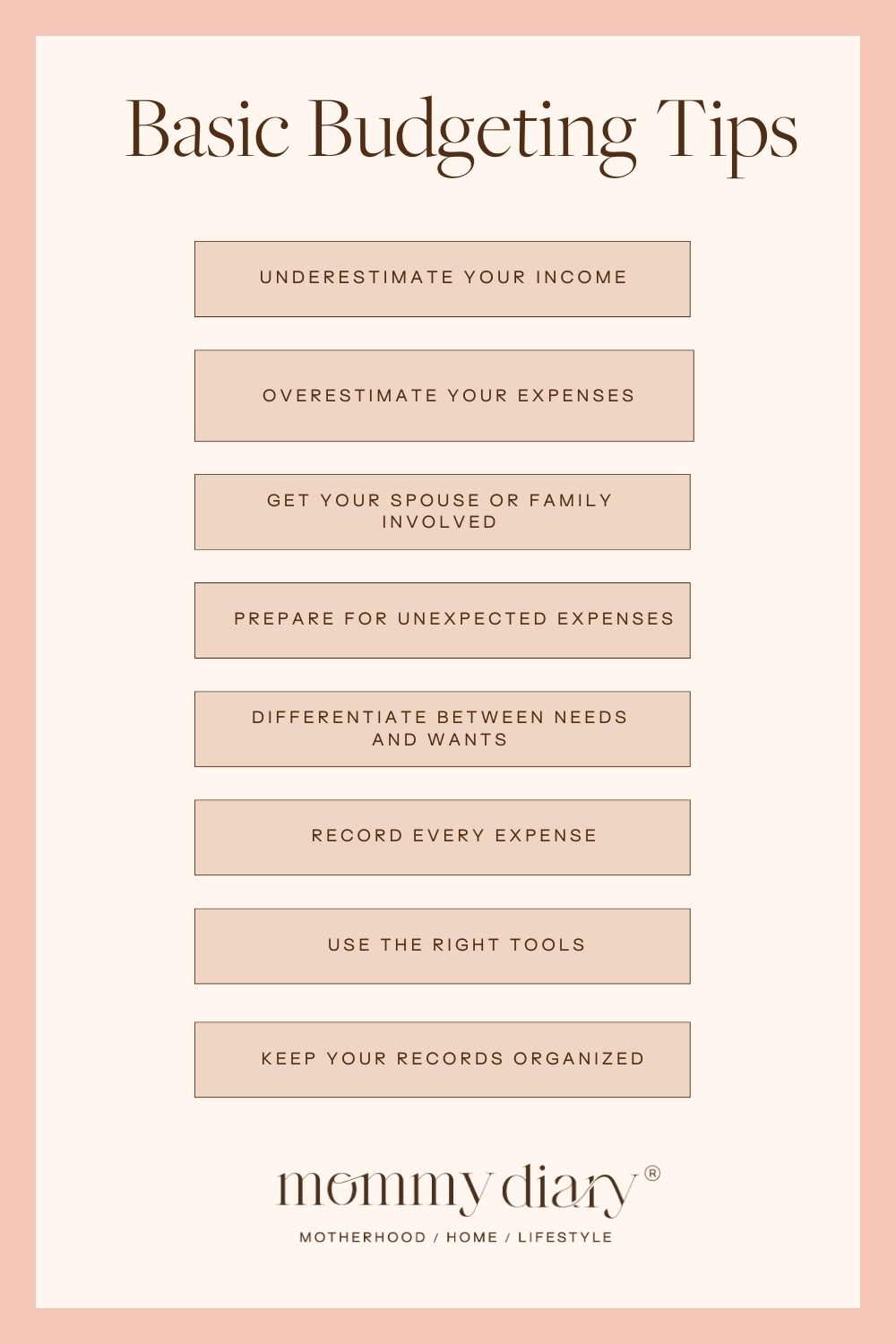

Fundamental Budgeting Techniques

Below are widely used budgeting frameworks—each suits different personalities and financial goals. Pick one and adapt it to your life.

:max_bytes(150000):strip_icc()/Term-Definitions_Zero-based-budgeting-101715d3484b488581579d0a729a6d47.jpg)

1. Zero-Based Budgeting

Every dollar gets a job. You assign income to categories (bills, groceries, savings, debt, fun) until your income minus expenses equals zero.

2. The 50/30/20 Rule

Simple rule-of-thumb: 50% needs, 30% wants, 20% savings/debt repayment.

3. Envelope System (Cash-Based or Digital)

Allocate money to spending “envelopes” for categories. When an envelope is empty, you stop spending in that category until the next period.

4. Pay-Yourself-First

Prioritize savings by automating transfers as soon as you’re paid.

Step-by-Step Plan to Master Monthly Expenses Management

Step 1 — Calculate Your True Income

Use net (take-home) pay, not gross. Include side hustle earnings and predictable irregular income (prorate if necessary).

Step 2 — Track Every Expense for 30–60 Days

Record everything: bills, subscriptions, coffee, tips. Use a spreadsheet, a notebook, or an app like Mint, YNAB, or EveryDollar.

Step 3 — Categorize and Prioritize

Group expenses into essentials, financial priorities (savings, debt), and discretionary spending. Rank within each category your non-negotiables vs. flexible items.

Step 4 — Build a Realistic Budget

Choose a budgeting technique and allocate funds based on your tracked spending and goals. Make small adjustments weekly rather than drastic cuts overnight.

Step 5 — Automate Where Possible

Automate bills, savings, and debt payments. Automation reduces missed payments and decision fatigue.

Step 6 — Review Monthly and Adjust Quarterly

Review your budget monthly; do a deeper audit every quarter. Look for trends and adjust allocations for upcoming expenses (seasonal bills, planned travel).

Practical Money-Saving Hacks for Monthly Expenses

Small, consistent changes compound. Here are effective money-saving hacks you can implement right away.

Reduce Recurring Subscriptions

Cut Utility Bills

Lower Grocery Bills

Trim Transportation Costs

Manage Debt Strategically

Smart Shopping Strategies

Advanced Tips for Financial Planning and Growth

Build an Emergency Fund

Aim for 3–6 months of essential expenses in a high-yield savings account. For freelancers or irregular incomes, target 6–12 months.

Invest for the Long Term

Contribute to retirement accounts (401(k), IRA) and take advantage of employer matches. After your emergency fund, prioritize investing to beat inflation.

Use Sinking Funds

Create separate savings buckets for predictable, irregular expenses (car maintenance, taxes, holidays) so they don’t blow your monthly budget.

Optimize Tax Strategy

Contribute to tax-advantaged accounts, keep records of deductible expenses, and consult a tax professional for complex situations. For self-employed people, make quarterly estimated tax payments to avoid penalties.

Plan for Big Financial Goals

Set specific, time-bound goals (down payment in 3 years, $10,000 emergency fund). Break them into monthly targets and automate transfers to dedicated accounts.

Real-World Examples and Case Studies

Case Study 1: The Newly Independent Renter

Claire moved into her first apartment with $3,000 monthly income. Using zero-based budgeting, she allocated: $1,000 rent, $300 utilities, $400 groceries, $300 student loan, $500 savings, and $500 for fungible expenses. By auditing subscriptions and cooking more, she cut discretionary spending by $150/month and increased savings rate to $650/month within three months.

Case Study 2: The Two-Income Family Tightening Up

Mark and Priya earn $9,000 combined after taxes. They were overspending on dining out and subscriptions. They switched to the envelope system for dining and grocery categories and agreed on two “no-spend” weeks per month. Result: $600/month reallocated to a home down payment fund within six months.

Tools, Templates, and Apps That Simplify Budgeting

Digital tools can reduce friction and make monthly expenses management easier. Consider:

Common Budgeting Mistakes and How to Avoid Them

How to Stay Motivated and Keep Momentum

Budgeting is a habit. Use these tactics to stay consistent:

Frequently Asked Questions (SEO-Friendly)

What is the easiest budgeting technique to start with?

The 50/30/20 rule is the simplest for beginners because it requires minimal tracking and gives flexible allocations for wants and needs.

How much should I save from each paycheck?

Aim to save at least 20% of your after-tax income if possible. If that’s not feasible, start with 5–10% and increase gradually until you reach 20% or more.

Can I budget if my income is irregular?

Yes. Use a baseline budget based on your lowest predictable monthly income and funnel extra earnings into savings or debt repayment. Sinking funds and a larger emergency fund help smooth irregularity.

Are budgeting apps safe?

Reputable budgeting apps use bank-level encryption and read-only access for account aggregation. Check reviews and privacy policies, and consider using manual spreadsheets for sensitive situations.

Internal and External Link Suggestions

Internal link recommendations:

External authoritative links to cite and open in a new window:

Image and Accessibility Suggestions

Schema Markup Recommendation

Add Article schema with properties:

<li"headline": "Master Your Finances: Best Budgeting Tips for Managing Monthly Expenses"

<li"author": {"@type": "Person", "name": "Financial Content Expert"}

<li"datePublished": "2026-01-03"

<li"keywords": "budgeting techniques, monthly expenses management, financial planning, money-saving hacks"

This helps search engines surface the article for relevant queries and enhances featured snippet potential.

Printable Budget Template (Simple)

| Category | Planned | Actual | Difference |

|---|---|---|---|

| Income (Net) | $0.00 | $0.00 | $0.00 |

| Housing | $0.00 | $0.00 | $0.00 |

| Utilities | $0.00 | $0.00 | $0.00 |

| Groceries | $0.00 | $0.00 | $0.00 |

| Transportation | $0.00 | $0.00 | $0.00 |

| Debt Payments | $0.00 | $0.00 | $0.00 |

| Savings & Investments | $0.00 | $0.00 | $0.00 |

| Discretionary | $0.00 | $0.00 | $0.00 |

| Total | $0.00 | $0.00 | $0.00 |

Social Sharing Optimization

Final Thoughts and Call to Action

Budgeting is less about depriving yourself and more about directing your money toward what truly matters. Start with one technique that fits your personality, track expenses for 30 days, and automate the rest. Small consistent actions—canceling unused subscriptions, creating sinking funds, and automating savings—add up to meaningful financial progress.

Take action now: Choose one budgeting technique above, set up your first budget, and automate a savings transfer today. If you want a ready-to-use spreadsheet or personalized plan, sign up for the weekly newsletter to get templates and coaching tips delivered to your inbox.

Author: Financial Content Expert — Practical advice rooted in proven budgeting techniques and modern personal finance best practices.